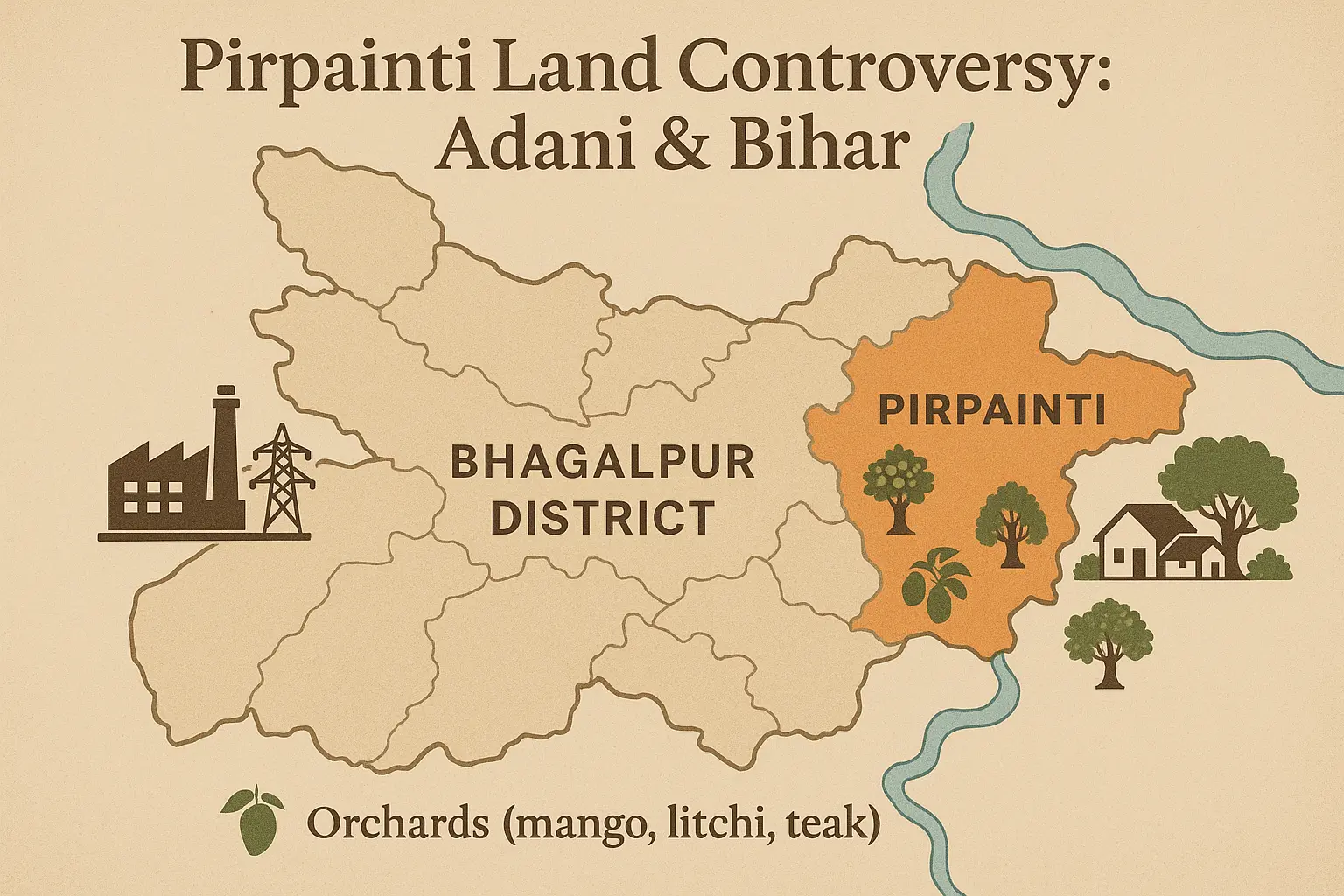

Bihar-Adani Land Deal: What We Know & What We Don’t

The Bihar government has recently approved a large thermal power project in Bhagalpur district, and the Congress party has responded with strong accusations. Congress alleges that over 1,000 acres of prime land and around ten lakh trees were leased to Adani Power for just ₹1/year under a 33-year lease, calling it “double looting.” Supporters of the project argue that procurement was competitive and the tariffs are justified. With the Bihar elections near, this controversy is now a central issue. Let’s break down the facts, the claims, and the risks for both sides.

What the Project Is (Facts)

- The project is a 2,400 MW ultra-supercritical thermal power plant at Pirpainti, Bhagalpur district, Bihar. Adani Power has received a Letter of Intent to build it, under a 25-year Power Supply Agreement (PSA) with the Bihar State Power Generation Company Ltd (BSPGCL).

- Adani emerged as the lowest bidder in a competitive tendering process, offering a tariff of ₹6.075 per unit.

- Investment is expected around USD 3 billion (or roughly ₹26,000–₹30,000 crore, depending on sources) and the plant is to be developed under a DBFOO (Design, Build, Finance, Own, Operate) model.

What Congress Alleges

Congress’s main allegations include:

- Land at ₹1/year – They claim 1,050 acres are leased to Adani for ₹1 per year for 33 years.

- Large number of trees included – Approximately ten lakh trees, including mango, litchi, teak, etc., are said to be on the land.

- Tariff concern – Power sold at ₹6.075/unit is alleged to be high compared with rates in states like Maharashtra or UP, where rates are reportedly between ₹3–₹5. Congress calls this “double loot” (free land + higher power cost).

- Alleged coercion/suppression of protests – Congress alleges farmers were intimidated, under house arrest, or prevented from protesting, especially around foundation ceremonies.

What the Bihar Govt / Adani Say (Defence & Clarifications)

Here are the counter-claims / clarifications by the state government and Adani:

- Competitive bidding followed – Bihar Industries Minister Nitish Mishra says the tender was competitive; several companies participated; Adani was the lowest bidder.

- Lease, not free sale – The land is being leased, not sold. Ownership remains with the government. Rent of ₹1/year is symbolic.

- Tariff reasoned – The rate of ₹6.075/unit includes production, fuel, coal linkage, infrastructure costs, environmental mitigations, etc. The government claims that comparing with other states without similar conditions is unfair.

- Compensation & acquisition process – Land acquisition dates back to 2012; earlier government units had intended to develop a power plant, but didn’t; now, the private sector is being involved. The government says farmers will be compensated, and the process will be followed.

What We Still Don’t Know / Issues Under Dispute

- Precise details of tree compensation – Are the trees accounted for? What valuation? How many orchards will be lost, and what compensation is planned?

- Exact status of land titles & acquisition – Which portions are private, which government, how much already acquired, whether farmers agree or have legal challenges.

- Tariff comparators – Whether the ₹6.075/unit is indeed significantly higher when adjusted for local cost of fuel, environmental norms, coal linkage, etc. Also, what are tariffs in similarly situated states under similar conditions?

- Impact on farmers’ livelihoods – Loss of orchards (fruit, etc.), displacement, and environmental impact (air, water) of the thermal power plant.

Supporters’ Case: Why They Believe This Is Justifiable

- Power demand & infrastructure need – Bihar is power-deficient; new capacity is essential for development, industry, and rural electrification. Supporters argue that this project could help bridge power shortages and improve reliability.

- Investment & jobs – With expected investment of ~$3 billion, thousands of jobs during construction and operations are expected, which supporters say will help economic growth in Bhagalpur and Bihar broadly.

- Lowest bidder and public process – Because Adani won via transparent bidding, supporters argue the decision is defensible. Leasing land at low symbolic cost is common in large infrastructure projects, especially to reduce capital cost, especially where upfront infrastructure costs are large.

Critics’ Case: Where Concerns Lie

- Fairness & transparency – Critics argue symbolic lease rates might mask undervaluation or preferential treatment. They worry about whether the bidding process was fully transparent, whether environmental impact assessments are robust, and whether local voices (farmers) are adequately consulted.

- Environmental & social impact – Loss of trees, orchards, displacement, loss of local income sources; air pollution and water usage concerns with a large coal power plant.

- Tariff burden on consumers – If the owner rate is higher, consumers may end up paying more, especially poor households or those away from urban centres.

- Political optics – With elections coming, critics say the deal may be driven by electoral politics rather than optimal energy planning.

Implications & What Happens Next

- Electoral impact – This controversy will likely feature heavily in the Bihar elections. Local voter sentiment in Bhagalpur (farmers, those affected) may influence the outcome.

- Precedents for land-leases & power projects – How this is handled can set norms for future projects: what “₹1 lease” really means, how compensation & environment are treated.

- Regulatory/judicial oversight – Courts or regulatory bodies may examine land acquisition, environmental clearances, and compensation. Transparency demands may increase.

- Choice & cost of fuel/coal linkage – As costs of coal, emission norms, and supply chains fluctuate, actual cost per unit may change, affecting viability.

Conclusion

The Bhagalpur/Adani land controversy brings forward many questions that go beyond just land rates or political blame. It touches on accountability, fairness in infrastructure development, and balancing growth with social and environmental justice. While Bihar stands to gain significant generation capacity and investment, the concerns raised about the lease terms, tariffs, and impact on communities are not trivial. Citizens, media, and policymakers must stay alert — ask for detailed disclosures, ensure fair compensation, and guard environmental safeguards.

Disclaimer: This article is based on publicly available reports and independent analysis. Readers are encouraged to consult multiple sources for a complete picture. Source - Adani, The Economic Times, Business Standard

No comments yet. Be the first to comment!