GST 2.0 Explained: What Becomes Cheaper, What Gets Costlier

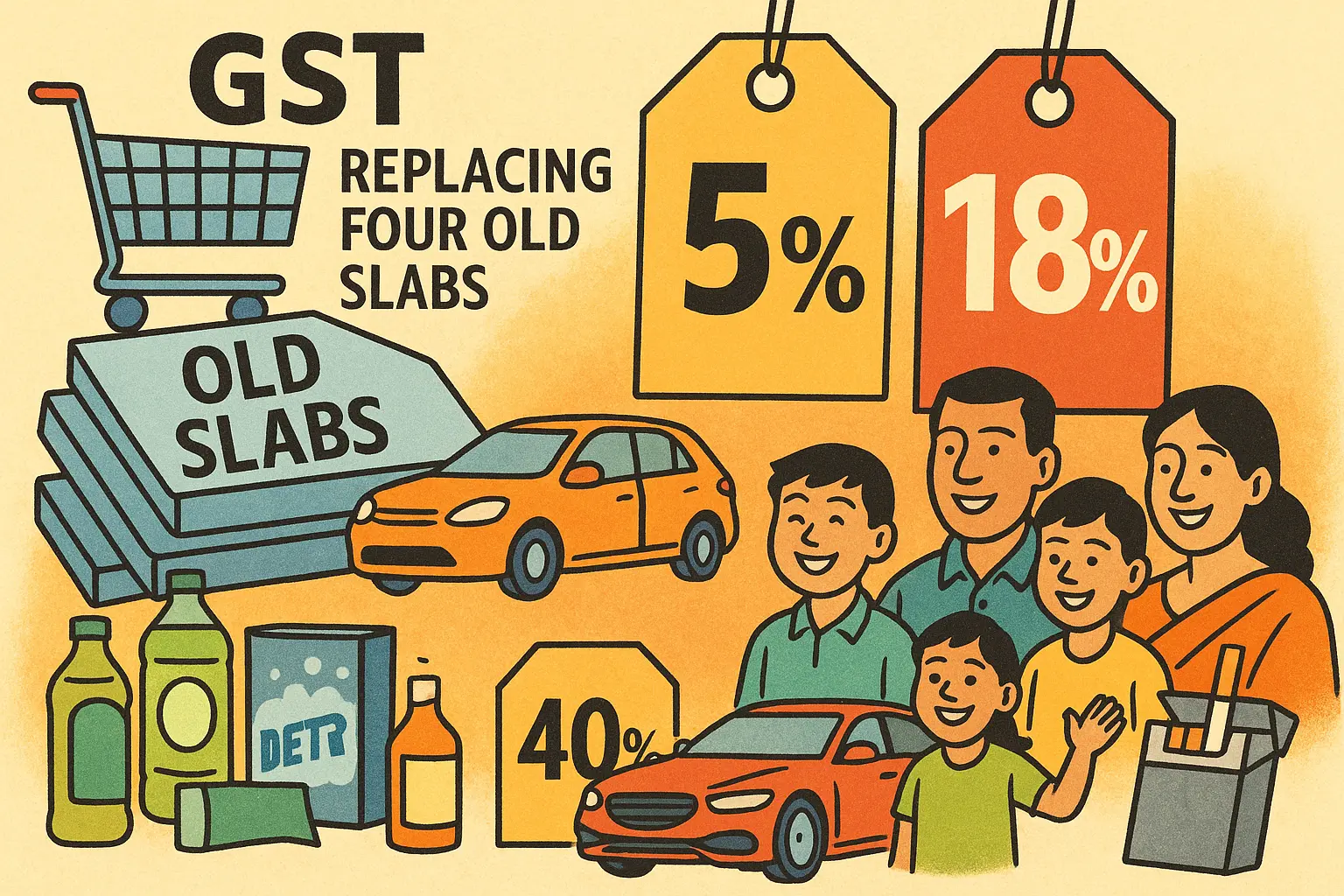

The thing the whole country was waiting for has finally happened. The GST Council, in its 56th meeting, has approved a two-slab GST structure. From September 22nd, only 5% and 18% GST rates will remain, while a special 40% rate applies to super-luxury items. For the middle class, this means lower taxes on essentials, appliances, insurance, and services. The government describe this as a Diwali gift for the people, and it could reshape India’s consumption and economic growth. Let’s break down what this reform means for you.

Why This Change Matters

Since GST was introduced in 2017, India has had five different slabs (0%, 5%, 12%, 18%, 28%). While it simplified many state taxes, the multiple slabs created confusion, disputes, and compliance headaches. The new two-tier system (5% and 18%) makes things clearer for businesses and consumers. It also helps reduce the tax burden on the middle class, which spends most on essentials and services.

What Are the New GST Rates?

- 5% slab → Essentials, daily-use goods, health services, affordable hotels.

- 18% slab → Most non-essentials, electronics, restaurants, vehicles under a certain size.

- 40% special tax → Super-luxury and sin goods.

99% of items earlier at 12% have been shifted to 5%.

Items at 28% now mostly fall in 18%.

Very few items are in the 40% category (SUVs, tobacco, casinos, sugary drinks).

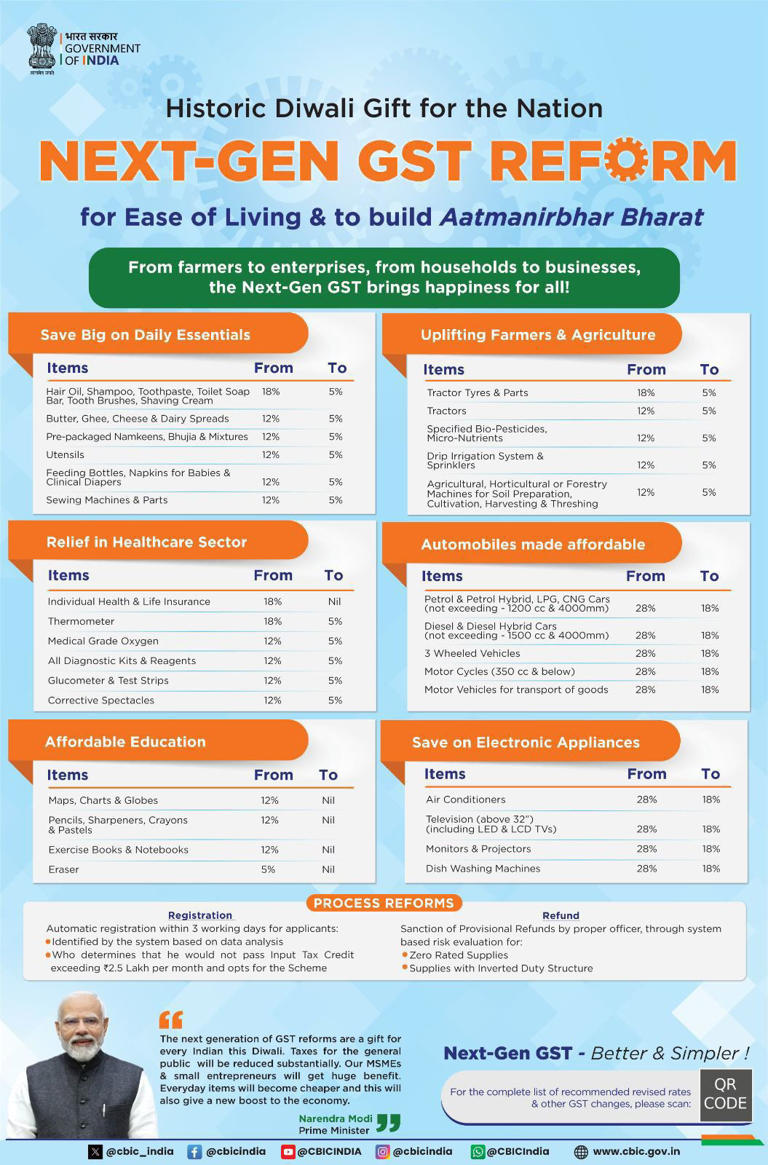

Everyday Impact — What Gets Cheaper

- Household essentials: Toothpaste, shampoo, soaps, biscuits, namkeen → down from 18% to 5%.

- White goods: TVs, ACs, washing machines → down from 28% to 18%.

- Healthcare: Insurance and medical devices → now exempt or reduced to 5%.

- Hospitality: Hotels under ₹7,500/night → now just 5% GST.

- Personal services: Gyms, beauty parlours, wellness → reduced from 18% to 5%.

- Automobiles: Small cars, two-wheelers, and EVs → much cheaper.

Example: A ₹30,000 AC that cost ₹38,400 with tax earlier, now costs ₹35,400 — a saving of ~₹3,000.

What Gets Costlier

- Luxury & sin goods: Tobacco, pan masala, gutkha, and cigarettes → 40% + cess.

- Sugary & caffeinated drinks: 40%.

- Luxury SUVs: Engines >1500cc, length >4m → 40%.

- Casinos, betting, and gambling: 40%.

This ensures government revenue is protected while keeping essentials affordable.

Impact on the Middle Class

- Lower household bills: Savings on essentials, toiletries, packaged food.

- Affordable health cover: Insurance and medical devices are cheaper.

- Mobility boost: Small cars, EVs, and two-wheelers are cheaper.

- Better planning: Predictable tax rates make budgeting easier.

Since consumption is 60% of India’s GDP, these savings can drive higher demand, more jobs, and stronger economic growth.

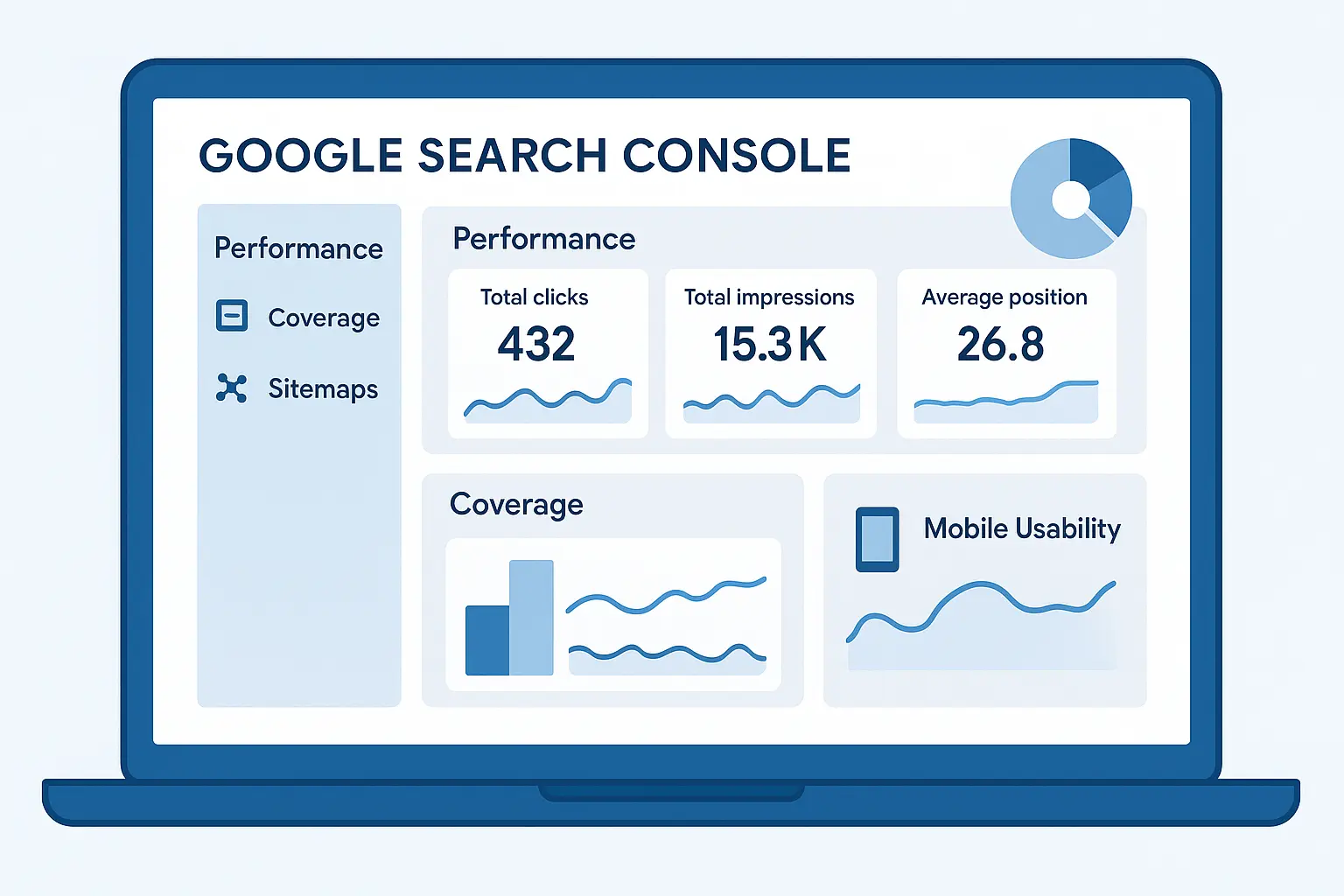

Effect on Government Revenue

- Short-term revenue loss: Estimated ₹1.5–2 lakh crore (~0.6–0.8% of GDP).

- States like Karnataka flagged concerns, but the compensation cess continues beyond 2026 to cover the gap.

- The government expects that higher consumption and compliance will make up for the loss in the long run.

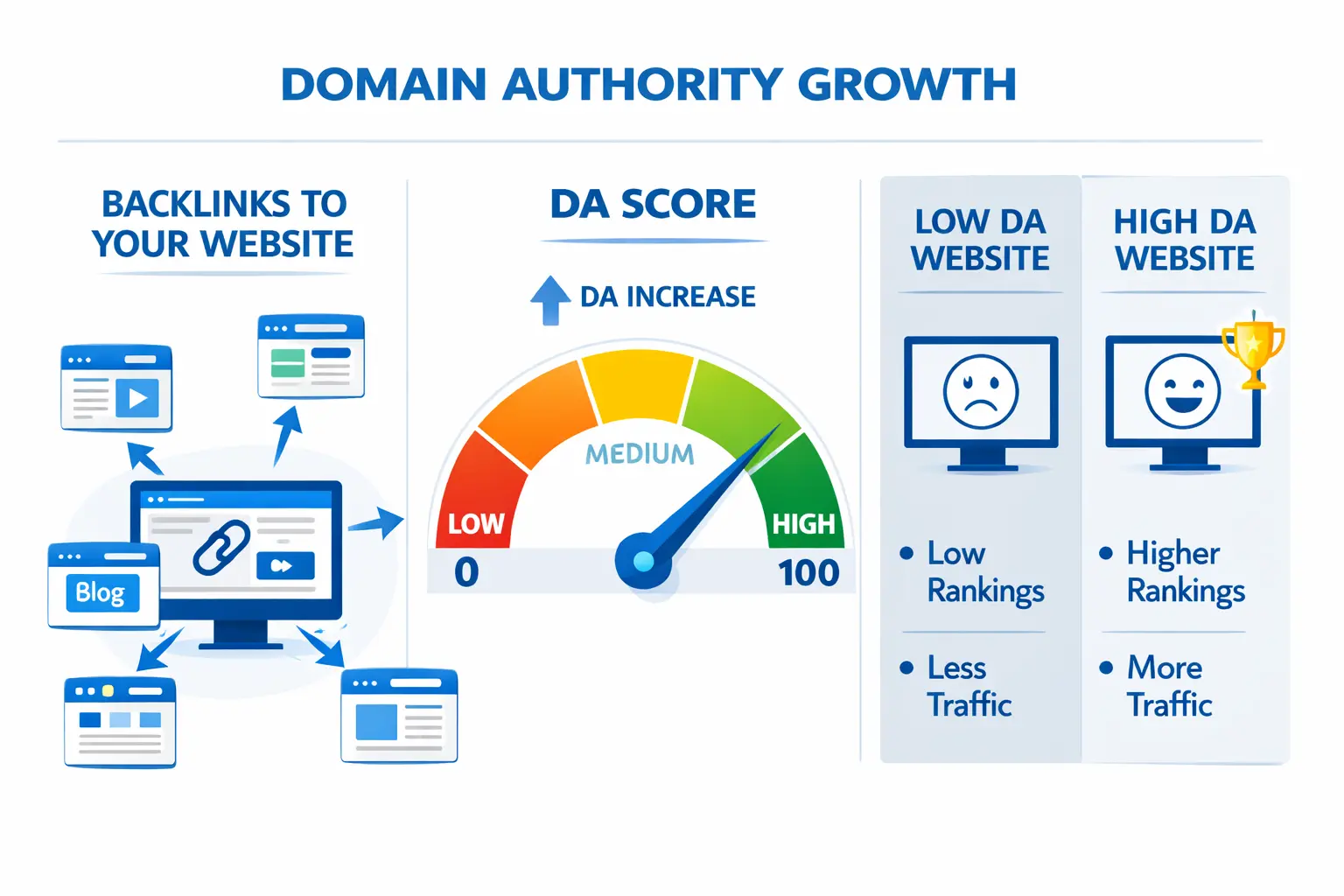

Businesses and Compliance

- Short-term challenges: Billing software, POS machines, and invoices must be updated before 22nd Sept.

- Stock at old tax rates: May cause some confusion; the government may issue clarifications.

- Long-term benefits: Easier compliance, faster refunds, less litigation, and a friendlier investment climate.

This is being called “GST 2.0” — a simpler, stronger version of the original 2017 reform.

Conclusion

The new two-slab GST system is more than just a tax change — it’s a shift in how India manages consumption and growth. For the middle class, it means real savings on daily items and services. For businesses, it promises simpler compliance and fewer disputes. And for the government, it’s a bold gamble that higher demand will cover revenue gaps. The next few months will show how smoothly this transition happens, but one thing is certain: this is the biggest GST reform since 2017, and it directly impacts every Indian household.

👉 What do you think?

Do you feel this GST reform will really benefit the middle class, or will it affect government revenue more?

💬 Share your thoughts in the comments!

No comments yet. Be the first to comment!