India’s External Debt Rises to $736 Billion: Should We Worry?

Recent months have seen India’s fast-growing external debt compared with debt-driven crises abroad, such as France’s austerity protests. While India’s scenario differs, the central issue is clear: rapid external borrowing raises the question of sustainability. To address how much debt is too much, we must first clarify what external debt is, why it’s significant, and what the latest numbers reveal about India’s economic stability.

What Exactly Is External Debt?

Borrowing is a normal part of every economy. Governments and companies often borrow from abroad to fund development and growth, but concerns arise when this external borrowing grows quickly.

External debt includes all outstanding loans and liabilities owed to non-residents by the government, private companies, banks, or even individuals.

Main components:

- Government borrowings: Loans from institutions like the World Bank or Asian Development Bank, and international bonds.

- Private sector borrowings: Corporate loans, external commercial borrowings (ECBs), and international bonds by companies like Reliance or Tata.

- NRI deposits: Money deposited in Indian banks by Non-Resident Indians.

- Short-term trade credit: Credit linked to imports/exports, usually repayable within a year.

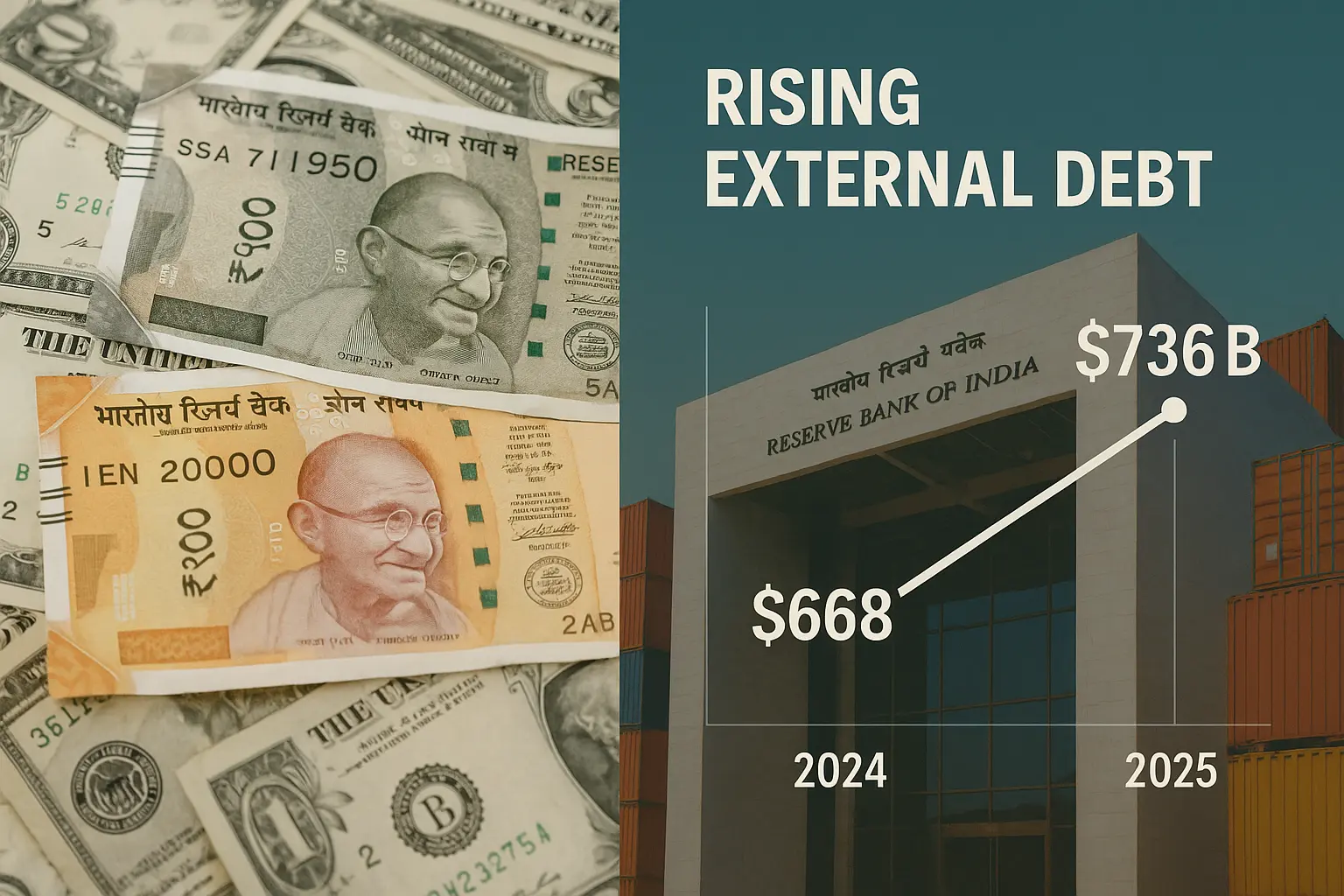

India’s External Debt in 2025

According to the Reserve Bank of India (RBI) and Finance Ministry data:

- March 2024: $668 billion

- March 2025: $736 billion

- Increase: $67.5 billion (10.1% growth in a year—the fastest since 2017–18)

In rupee terms, this equals ₹63 lakh crore, a 13% rise due to the rupee weakening from ₹83–84 per US dollar to around ₹88–90.

- Debt-to-GDP ratio: Rose from 18.5% to 19.1% in a year.

- Short-term debt: Accounts for ~41% of total debt, the riskiest portion since it matures within a year.

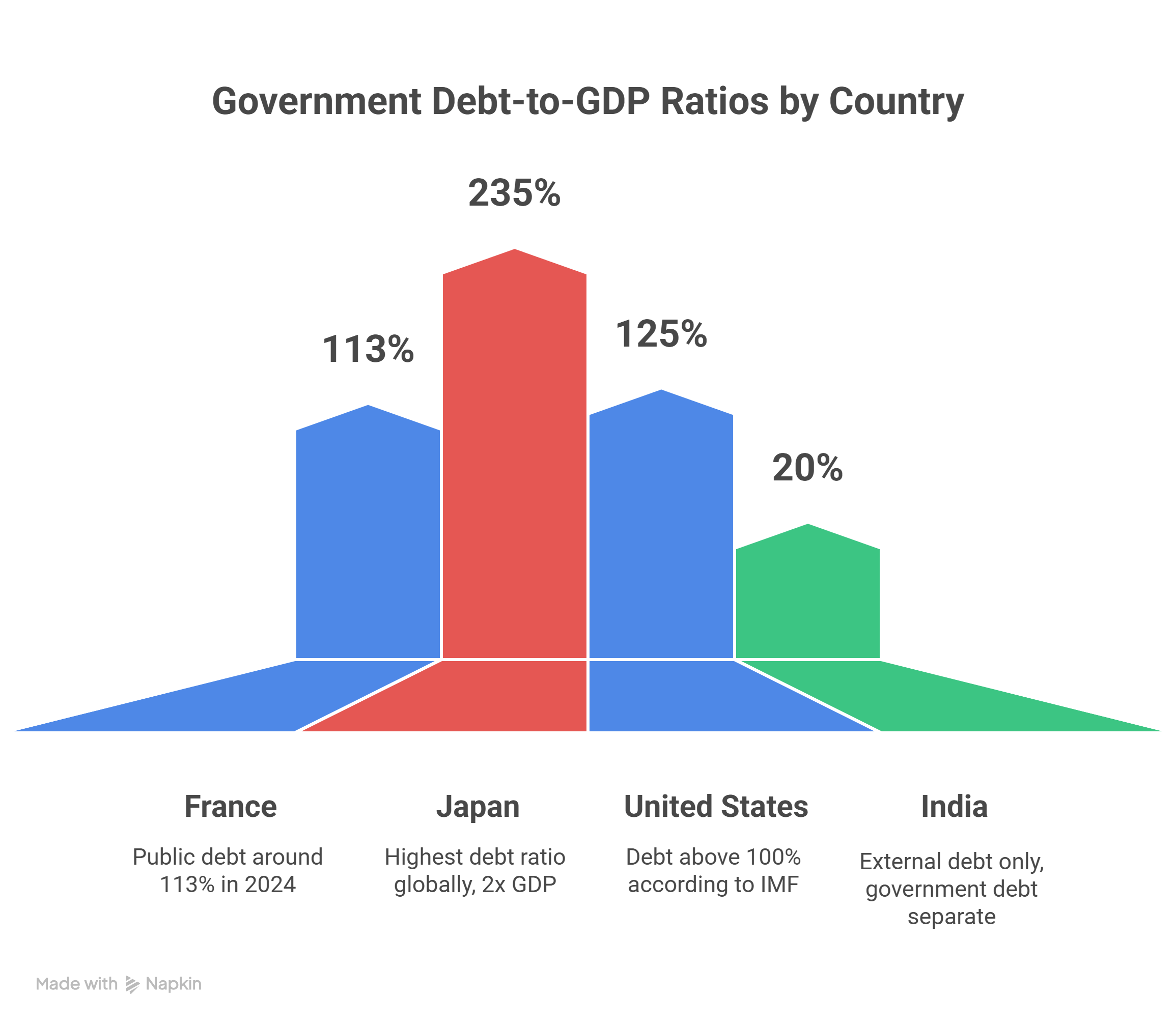

What This Comparison Shows

- India’s external debt-to-GDP around 19-20% (per external debt definition), is much lower than public debt-to-GDP ratios of advanced economies like France, Japan, the USA, etc.

- High debt-to-GDP in advanced economies is common due to past stimulus, large public spending, ageing populations, etc.

- India’s external debt is a subset of its total government and private liabilities; public debt (internal + external) is higher if you include domestic borrowing.

Why Did Debt Rise So Fast?

- Widening Current Account Deficit (CAD): Imports of oil, electronics, and gold rose, while FDI inflows didn’t keep pace.

- Corporate borrowings: Indian companies borrowed abroad due to lower costs compared to domestic credit.

- NRI deposits: Increased flows added to external liabilities.

- Rupee depreciation: Higher repayment burden in rupee terms.

- Short-term trade credit: Jumped by $18 billion, reflecting strong import demand.

Why It Matters: Risks of Rising External Debt

- Foreign exchange risk: If the rupee weakens further, repayment costs balloon.

- Rollover risk: Heavy short-term borrowings mean India often repays old loans with new ones—a risky cycle.

- Interest costs: Corporate foreign borrowings carry higher interest rates than government loans.

- Debt sustainability: While 19.1% debt-to-GDP is manageable, the pace of increase is concerning.

Why It’s Not a Crisis Yet

- Strong forex reserves: At ~$700 billion, India’s reserves cover nearly 90% of its external debt.

- Debt-service ratio stable: Exports and remittances provide steady inflows to meet repayment needs.

- Diversified borrowings: Debt is spread across government, corporate, and NRI channels.

- Economic growth: India remains among the world’s fastest-growing economies, which boosts investor confidence.

Supporters vs. Critics

Supporters argue:

- External debt is part of growth. Borrowings, when used productively for infrastructure or technology, can fuel long-term gains.

- India’s debt-to-GDP ratio is far lower than advanced economies—Japan’s is over 250%, the U.S. over 120%.

- Healthy reserves mean India can weather shocks better than many peers.

Critics warn:

- The rise in short-term debt makes India vulnerable to sudden capital flight.

- Dependence on external borrowing exposes the rupee to global volatility.

- If borrowed funds are not channelled into productive use, repayment pressure could build.

Lessons from France & Global Context

France’s current fiscal unrest shows how excessive borrowing can trigger social and political upheaval. While India’s debt-to-GDP is modest compared to France (where it exceeds 110%), the lesson is clear: unchecked debt growth can limit policy flexibility and erode public trust. India must balance external borrowing with sustainable domestic growth.

Conclusion

India’s external debt now exceeds $736 billion—a rapid jump signalling

the need for caution. While robust reserves and growth currently keep risks in check, the accelerating pace and large short-term component highlight the core argument: responsible, productive borrowing is critical to sustainable economic stability.

Track official RBI and Finance Ministry updates, and pay attention to how borrowed funds are deployed. Responsible borrowing today means economic stability tomorrow.

Disclaimer: This article is based on publicly available reports and independent analysis. Readers are encouraged to consult multiple sources for a complete picture.

No comments yet. Be the first to comment!