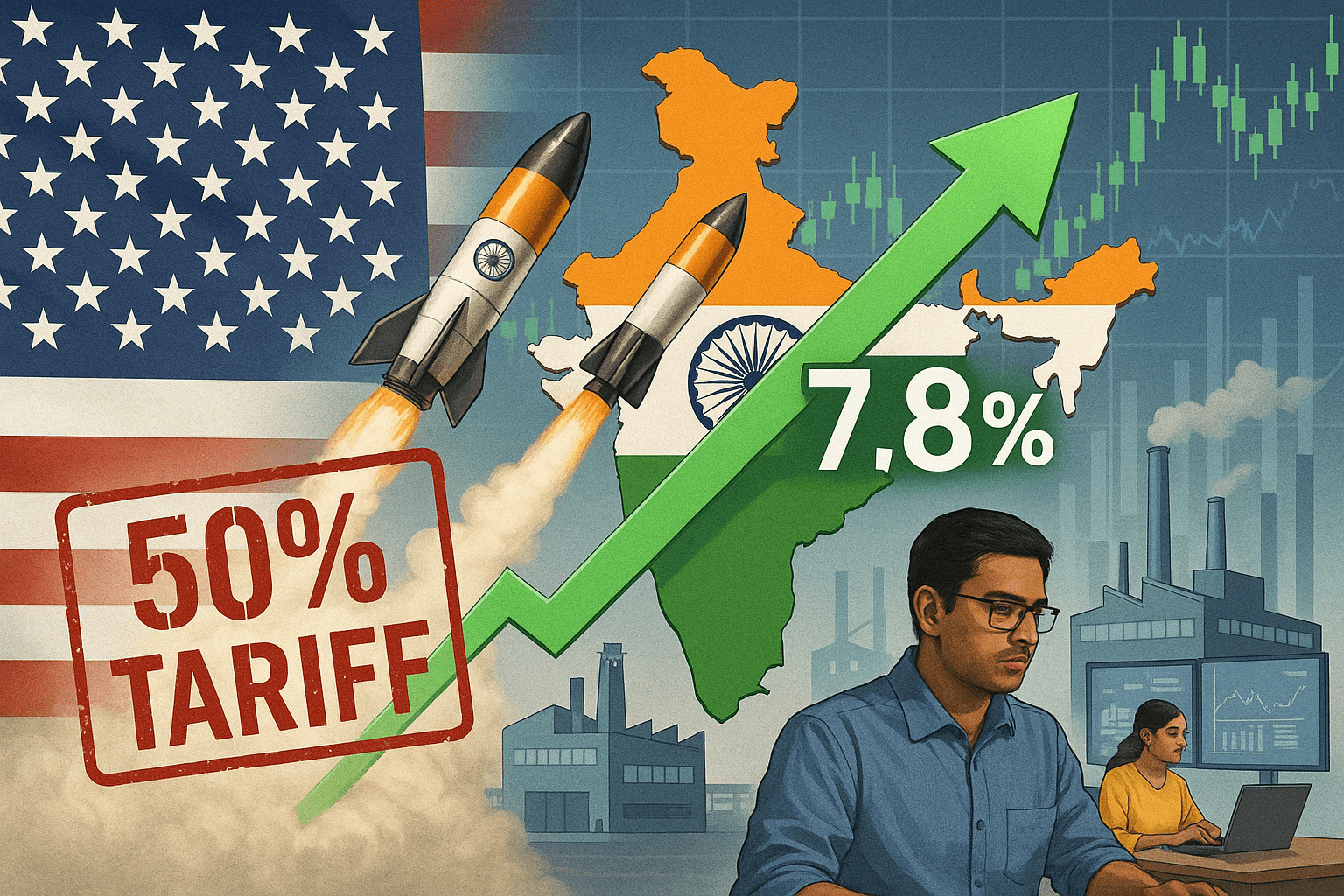

India’s GDP Shocks the World: Q1 Growth Hits 7.8% — Beating All Predictions

Most analysts believed India’s economy would cool down this year. Predictions for Q1 GDP growth were stuck around 6.4–6.7%, with even the RBI expecting just 6.5%. But the reality is far brighter. India’s GDP grew 7.8% in Q1 2025–26, the strongest rate in the last five quarters. This performance not only beats expectations but also reaffirms India’s position as the world’s fastest-growing major economy.

Who Releases GDP Data?

India’s financial year runs from March to April. GDP figures are released with a two-month lag by the National Statistical Office (NSO), under the Ministry of Statistics and Programme Implementation.

- Q1 (April–June 2025) growth: 7.8% YoY

- Previous year (Q1 2024–25): 6.1%

- This makes Q1 the strongest quarter since the first quarter of 2025.

What Does 7.8% Growth Mean?

GDP measures the total value of goods and services produced.

- Q1 2024 output: ₹44.4 lakh crore

- Q1 2025 output: ₹47 lakh crore

- That’s a ₹2.6 lakh crore jump in real GDP.

- At current prices (nominal GDP), the number is even higher at ₹86 lakh crore (+8.8%).

Why it matters: Real GDP strips out inflation, so this is genuine, healthy growth.

The Formula Behind Growth

Economists often explain GDP using:

GDP = C + I + G + NX

- Consumption (C): +7% → Indian households are spending more.

- Investment (I): +7.8% → Infrastructure, real estate, and manufacturing investments are rising.

- Government Spending (G): +7.4% → Strong capex push continues.

- Net Exports (NX): Positive this time → higher exports, slightly lower imports.

Sector-Wise Performance

Measured by GVA (Gross Value Added):

- 🌾 Agriculture: Positive, supported by early monsoon.

- 🏭 Manufacturing: +7.7% → strong demand in steel, cement, autos.

- 🚧 Construction: +7.6% → housing & infra boom.

- ⚡ Utilities: Steady rise in electricity & water supply.

- 🏨 Trade, hotels, transport, communication: +8.6% → tourism & aviation surged.

- 💼 Financial & real estate services: +9.5% → fintech, lending growth.

- 🛡️ Public administration & defense: +9.8% → government expenditure strong.

Clearly, services and infrastructure powered this quarter’s boom.

Why Growth Beat Expectations

- Government spending: Record highway, railway, and defence projects.

- Construction boom: Housing demand lifted the steel & cement sectors.

- Rural support: Early rains boosted crop output & rural demand.

- Services expansion: IT, aviation, tourism, and banking outperformed.

- High tax revenues: GST collections at all-time highs → show robust consumption.

India vs The World

- India Q1 GDP: 7.8%

- US: ~3.3%

- China: lower than India

India is once again the world’s fastest-growing major economy, strengthening its claim as a key engine of global growth.

Risks Ahead

Despite a great Q1, challenges remain:

- US tariffs: 50% duty on Indian exports like textiles could hit Q2.

- Weak private investment: Still too dependent on government spending.

- Global headwinds: Trade tensions & FII outflows.

- Urban demand slowdown: Cars, luxury goods are cooling.

- Inflation threats: Food prices (tomatoes, pulses, milk) remain a worry.Flood damage: May reduce agricultural output in Q2.

Outlook for FY 2025–26

Earlier forecasts suggested India would remain below 7% this year. But after this 7.8% Q1 shocker, the economy will likely cross 7% growth for the full year.

This strengthens India’s position as the most resilient and promising growth story in the world.

Conclusion

India’s Q1 GDP growth of 7.8% is more than just a statistic — it’s proof of resilience and momentum. Even with tariffs, inflation risks, and global headwinds, India has shown that domestic demand, government-led investment, and a booming services sector can keep growth strong. The focus now must be on encouraging private investment and tackling inflation. If managed well, 2025–26 could firmly establish India as the world’s fastest-growing economy.

No comments yet. Be the first to comment!